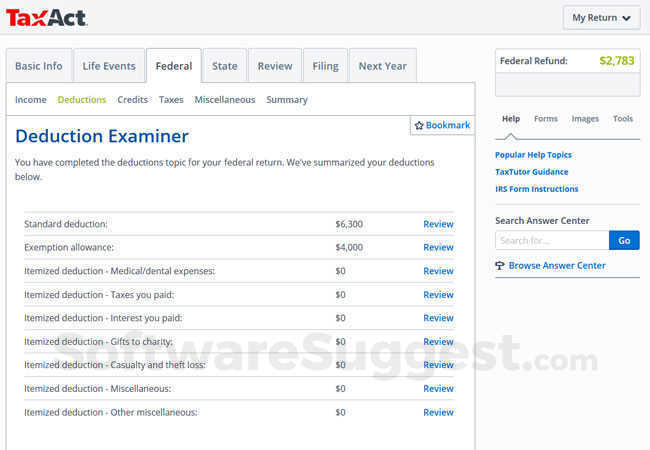

How Do TaxAct's Prices Compare With the Competition? As of this writing, the price is $114.95, which may or may not go up to $229.95. It includes federal prep and filing and one state return (all TaxAct versions), refund transfer (meaning your fees for TaxAct are deducted from your refund), E-File Concierge (personalized help with return status), and Audit Defense (a pro will deal with the IRS for you). You can save money by buying a bundle of TaxAct products called the All-Inclusive Bundle. The company hasn’t officially announced whether prices will go up later in the tax filing season, but they always have. State returns for all Deluxe, Premier, and Self-Employed cost $44.95 per state filed. (Opens in a new window) Read Our Liberty Tax 2023 (Tax Year 2022) Review Self-Employed ($64.95 for federal), the version I reviewed, is the top-of-the-line service and the only one to offer Schedules C and F. If you have to report investments or rental property, you need Premier ($34.95 for federal). You can itemize deductions in this version and claim numerous credits in addition to reporting on Health Savings Accounts (HAS). The next step up is Deluxe, which is currently $24.95 for federal filing. The major topics included in the free version are W-2 income, student expenses, earned income credit (EITC), child tax credit (CTC), retirement income, and unemployment. There's still a free federal version, but it doesn't support schedules A–F, and state returns cost $39.95 apiece. TaxAct broke the price barrier when it introduced free online personal tax preparation and e-filing for both federal and state several years ago, but it no longer offers that.

Read our editorial mission (Opens in a new window) & see how we test (Opens in a new window). Since 1982, PCMag has tested and rated thousands of products to help you make better buying decisions. How to Set Up Two-Factor Authentication.How to Record the Screen on Your Windows PC or Mac.

0 kommentar(er)

0 kommentar(er)